Is the Gig economy setting the stage for a return of the OpenMEP® retirement plan concept?

TAG Resources President Troy Tisue thinks so.

On Tuesday, February 6, 2018, the U.S. Senate subcommittee on Primary Health and Retirement Security opened a

hearing and roundtable discussion on the impact of gig workers and the future of retirement savings which included Troy Tisue, President of TAG Resources, a leader in retirement plan administration outsourcing.

About the Gig Economy:

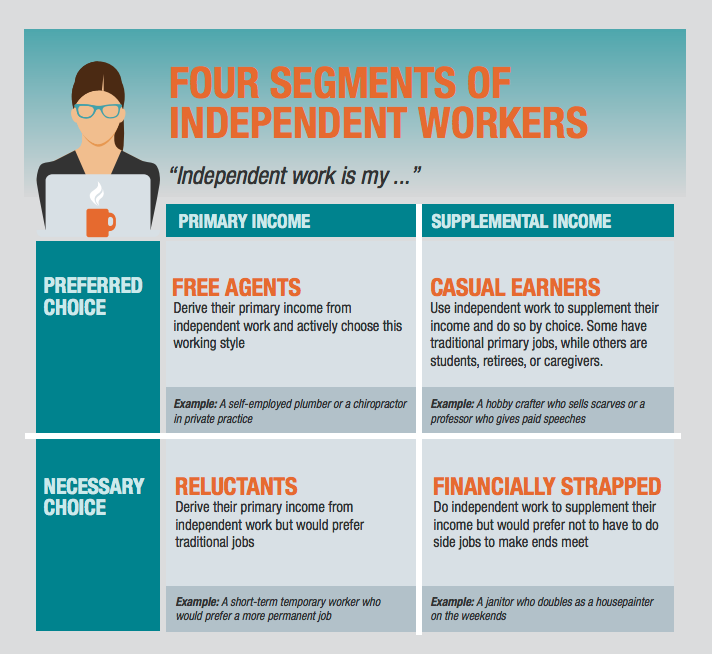

The US Department of Labor and Statistics classifies a “gig” worker as a contingent worker or independent contractor. According to the statistics cited by any number of surveys and from any random think tank, the number of gig workers might surpass 40% of the workforce in the next couple of years.

About the Gig Economy:

The US Department of Labor and Statistics classifies a “gig” worker as a contingent worker or independent contractor. According to the statistics cited by any number of surveys and from any random think tank, the number of gig workers might surpass 40% of the workforce in the next couple of years.

Tisue’s statement to the subcommittee focused on TAG Resources’ retirement program, Open MEP®. In 2004, TAG first provided professional plan fiduciary service and aggregation of plan investments for small and medium 401(k) plan sponsors through use of the multiple employer plan (MEP) model, where unrelated employers could establish and co-sponsor a more robust single retirement plan. Then, TAG created the Open MEP® concept to leverage cost, provide a better service model, and provide fiduciary protection.

“There are a number of designs under which the Open MEP® structure could be used for the gig economy; these are only the most obvious examples. Permitting Open MEPs would enable the innovativeness of the marketplace to design MEPs which could accommodate most circumstances, while providing the independent worker both ERISA protections as well as institutional pricing which would not otherwise be available to her or him,” said Tisue. "TAG Resources has for many years been in the marketplace as the country’s leading aggregator of plan services for both closed MEPs and for those employers who would otherwise benefit from changes which would permit Open MEPs.”

Other participants in the subcommittee hearing included Camille Olson, of Chicago, representing The U.S. Chamber Of Commerce; Vikki Nunn, CPA and Shareholder of

the accounting firm of Porter, Muirhead, Cornia & Howard, of Casper, WY; and Monique Morrissey, an Economist with the Economic Policy Institute in Washington, DC.

There are several common myths around retirement plans that prevent small businesses from offering these benefits, but the facts can help

There are several common myths around retirement plans that prevent small businesses from offering these benefits, but the facts can help About the Gig Economy:

The US Department of Labor and Statistics classifies a “gig” worker as a contingent worker or independent contractor. According to the statistics cited by any number of surveys and from any random think tank, the number of gig workers might surpass 40% of the workforce in the next couple of years.

Tisue’s statement to the subcommittee focused on TAG Resources’ retirement program, Open MEP®. In 2004, TAG first provided professional plan fiduciary service and aggregation of plan investments for small and medium 401(k) plan sponsors through use of the multiple employer plan (MEP) model, where unrelated employers could establish and co-sponsor a more robust single retirement plan. Then, TAG created the Open MEP® concept to leverage cost, provide a better service model, and provide fiduciary protection.

“There are a number of designs under which the Open MEP® structure could be used for the gig economy; these are only the most obvious examples. Permitting Open MEPs would enable the innovativeness of the marketplace to design MEPs which could accommodate most circumstances, while providing the independent worker both ERISA protections as well as institutional pricing which would not otherwise be available to her or him,” said Tisue. "TAG Resources has for many years been in the marketplace as the country’s leading aggregator of plan services for both closed MEPs and for those employers who would otherwise benefit from changes which would permit Open MEPs.”

Other participants in the subcommittee hearing included Camille Olson, of Chicago, representing The U.S. Chamber Of Commerce; Vikki Nunn, CPA and Shareholder of

the accounting firm of Porter, Muirhead, Cornia & Howard, of Casper, WY; and Monique Morrissey, an Economist with the Economic Policy Institute in Washington, DC.

About the Gig Economy:

The US Department of Labor and Statistics classifies a “gig” worker as a contingent worker or independent contractor. According to the statistics cited by any number of surveys and from any random think tank, the number of gig workers might surpass 40% of the workforce in the next couple of years.

Tisue’s statement to the subcommittee focused on TAG Resources’ retirement program, Open MEP®. In 2004, TAG first provided professional plan fiduciary service and aggregation of plan investments for small and medium 401(k) plan sponsors through use of the multiple employer plan (MEP) model, where unrelated employers could establish and co-sponsor a more robust single retirement plan. Then, TAG created the Open MEP® concept to leverage cost, provide a better service model, and provide fiduciary protection.

“There are a number of designs under which the Open MEP® structure could be used for the gig economy; these are only the most obvious examples. Permitting Open MEPs would enable the innovativeness of the marketplace to design MEPs which could accommodate most circumstances, while providing the independent worker both ERISA protections as well as institutional pricing which would not otherwise be available to her or him,” said Tisue. "TAG Resources has for many years been in the marketplace as the country’s leading aggregator of plan services for both closed MEPs and for those employers who would otherwise benefit from changes which would permit Open MEPs.”

Other participants in the subcommittee hearing included Camille Olson, of Chicago, representing The U.S. Chamber Of Commerce; Vikki Nunn, CPA and Shareholder of

the accounting firm of Porter, Muirhead, Cornia & Howard, of Casper, WY; and Monique Morrissey, an Economist with the Economic Policy Institute in Washington, DC.